Published October 7, 2014 by Oregon Center for Public Policy

By Chuck Sheketoff

Say that you’re the sole breadwinner for your family and you earn $100,000 a year in Oregon. Would you pack your belongings and move your family north to Washington for a $40 monthly raise? It’s hard to imagine.

That is why any Oregon business worried that it might lose employees to firms in Washington or other states, or have better employee retention if the company relocates outside Oregon, can rest assured. Generally, taxes matter little, if at all, when it comes to where people choose to locate. And Oregon’s tax structure in particular should make little difference to workers on whether to stay or go.

There is no shortage of research demonstrating that personal income tax rates have a negligible impact on people moving from state to state.[1] When most people move — across town, to another part of the state, or even to a different state — it’s generally for better schools, a higher quality of life, a major career opportunity, better weather or family reasons.

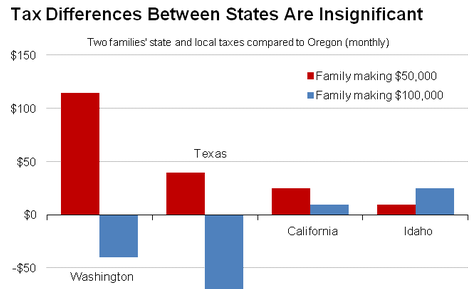

In any event, the tax difference between Oregon and other states is small or even in Oregon’s favor, as demonstrated by an analysis conducted by the nonpartisan Institute on Taxation and Economic Policy (ITEP).

The Center asked ITEP to compare the state and local taxes paid by Oregon families earning $50,000 and $100,000 with families earning the same amounts in California, Washington, Idaho and Texas — four states Oregon business leaders sometimes cite as our competition.[2]

Households with $50,000 a year in income — middle-income households — have a slight tax advantage in Oregon. They would pay more in state and local taxes if they lived and worked in each of those four other states. How much more? They would pay about $115 more per month in taxes in Washington, $10 more in Idaho, $40 more in Texas and $25 more in California.[3]

Households earning twice that — $100,000 a year, placing them in the top 20 percent of income earners — have a tax disadvantage in Oregon compared to Washington and Texas, but the difference is minimal. Such families would save about $40 a month in state and local taxes by moving to and working in Washington. Those families would save $100 per month if they moved as far as Texas for similarly paid work. On the other hand, the workers would pay $25 more each month in taxes in Idaho and $10 more in California.

Taxes don’t matter much, if at all, when it comes to employees making choices about where to work. Part of the reason taxes don’t matter much is that the difference between Oregon and other states is small or even in Oregon’s favor. Oregon business leaders have no reason to worry about losing middle-income employees or their higher-income counterparts due to competing tax systems.

[1] Mazerov, Michael, State Taxes Have a Negligible Impact on Americans’ Interstate Moves, Center on Budget and Policy Priorities, May 21, 2014; Tannenwald, Robert et. al., Tax Flight Is a Myth: Higher State Taxes Bring More Revenue, Not More Migration, Center on Budget and Policy Priorities, August 4, 2011; Young, Cristobal and Charles Varner,Millionaire Migration and State Taxation of Top Incomes: Evidence from a Natural Experiment, National Tax Journal, June 2011; Young, Cristobal and Charles Varner,Millionaire Migration in California: The Impact of Top Tax Rates, 2012.

[2] From 1993 to 2010, Oregon had net out-migration to six states. Texas and California were not among them. In fact, there has been massive net in-migration to Oregon from California. The only state that has had significant net in-migration from Oregon is Washington. A lot of those people move from Oregon to Washington suburbs for lower housing costs, but work in Oregon where their incomes are still taxable. Mazerov, Michael, State Taxes Have a Negligible Impact on Americans’ Interstate Moves, Center on Budget and Policy Priorities, May 21, 2014,

[3] This analysis uses California’s current, temporary tax rates. When these temporary rates expire, the rates will decline. Under the lower permanent rates, there is no difference for the $100,000 per year household, and the difference for the $50,000 per year household goes down to $250 per year.