Published March 30, 2015 by Oregon Center for Public Policy

Although Oregon has a minimum income tax for corporations, 492 corporations paid less than the minimum in tax year 2012.[1] Some corporations paid nothing at all.

When corporations avoid the minimum tax they deprive the state of revenue to invest in schools and other key public structures. Lawmakers should reinstate the corporate minimum tax for all corporate taxpayers.

Download a copy of this fact sheet:

Hundreds of Corporations Escape the Minimum Tax (PDF)

How Can a Corporation Pay Less Than the Corporate Minimum Tax?

Oregonians expect all corporations to pay something to support the common good. The corporate minimum tax has been on the books since 1929. In 2010, Oregon voters affirmed a new corporate minimum tax structure that had been approved by the 2009 legislature.

A 2013 Oregon Supreme Court decision, however, enabled corporations to avoid paying the minimum tax. In a lawsuit brought by the trucking company Con-way, the court ruled that corporations could apply certain tax credits to reduce or cancel their Oregon corporate minimum tax obligations.[2] The Con-way ruling opened the door for other corporations to reduce, or wipe out entirely, their minimum tax bill.

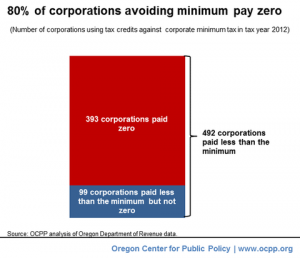

Most Corporations Avoiding the Minimum Pay Nothing

In tax year 2012, 492 corporations paid less than the minimum tax through the use of tax credits.[3] Of those, 393 paid no minimum tax.

That means that of all the corporations that avoided paying the minimum, 80 percent of them got down all the way to zero.

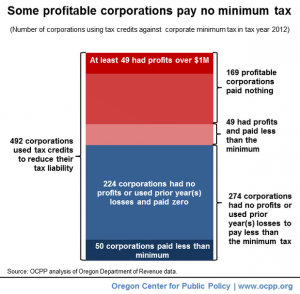

Some Profitable Corporations Pay Zero Income Taxes

Of the 492 corporations that paid less than the minimum tax in tax year 2012, 218 had “taxable income” — profits for tax purposes. Taxable income is what is left after a company subtracts business expenses and other deductions under tax code accounting rules, not general accounting rules.

Of these 218 profitable corporations, 169 paid zero in taxes.

Among the group paying zero were at least 49 corporations with profits over $1 million.[4]

The remaining 274 corporations paying less than the minimum either had no profits for tax purposes or used prior year(s) losses to reduce profits to zero. Of those, 224 corporations paid nothing.

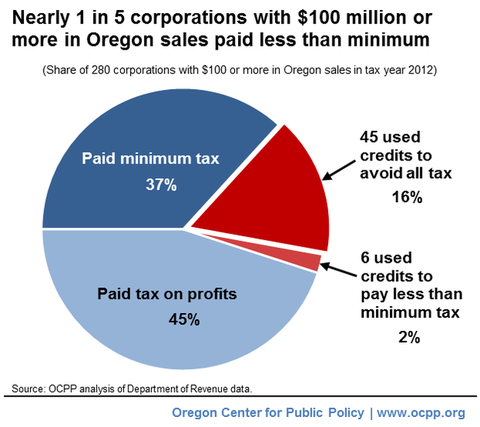

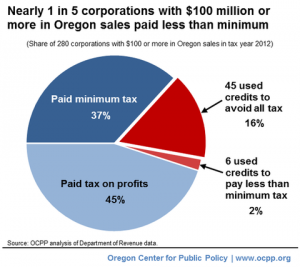

Some Corporations with the Highest Level of Oregon Sales Pay No Income Taxes

For the 2012 tax year, 280 corporations reported Oregon sales of $100 million or more.

Of that group, nearly one in five (18 percent) paid less than corporate minimum in tax year 2012.

Specifically, 51 paid less than the corporate minimum tax, and 45 of those got away with paying nothing.

What Are the Names of the Corporations Avoiding Oregon’s Minimum Tax?

Lawmakers and the public do not know the names of the corporations paying less than the corporate minimum tax. Oregon lawmakers have not set up a system that would require corporations to disclose their tax liability to the public.

Avoidance of the Corporate Minimum Tax Costs Millions

If the legislature fails to fix the problem, the court-sanctioned end-run around the corporate minimum tax will cost a projected $18 million during the 2015-17 budget period and about $19 million during 2017-19.[5]

Conclusion

Corporate tax avoidance harms all Oregonians. The loss of tax revenue shifts the cost for state services to other taxpayers. It also makes it harder for Oregon to put more teachers in classrooms, make college more affordable and invest in the other public structures that create opportunity and a strong business climate.

The 2015 Oregon legislature should close the corporate minimum tax loophole. Doing so would ensure that all corporations contribute something to support the common good.

[1] Unless otherwise noted, all figures are OCPP analysis of Oregon Department of Revenue, Oregon Corporate Excise and Income Tax: Characteristics of Corporate Taxpayers, 2014 and Department of Revenue data emailed from Mary Fitzpatrick, Oregon Department of Revenue, to Tyler Mac Innis, Oregon Center for Public Policy, March 10, 2015.

[2] But for the Supreme Court decision, Con-way would have paid a $75,000 corporate minimum tax based on having $79 million in Oregon sales. The court allowed Con-way to use business energy tax credits it had purchased to offset the minimum tax.

[3] The term “corporations” in this report refers to C-corporations. The number of corporations paying less than the corporate minimum could change as a result of amended tax returns.

[4] When showing the number of companies paying no minimum tax, for confidentiality reasons the Department of Revenue (DOR) combines the number of companies with profits between $500,000 and $1 million with those of $1 million or more in profits. DOR documents show that 12 companies with profits between $500,000 and $1 million used credits to reduce at least some of their taxes in tax year 2012. DOR data also shows that 61 companies in the combined category of $500,000 or more in profits reduced their taxes to zero. To make the most conservative estimate of the number of companies with profits above $1 million who paid zero in taxes in 2012, one should assume the 12 companies with profits between $500,000 and $1 million all reduced their taxes to zero. Therefore, at least 49 (61 minus 12) of the corporations with taxable income of $1 million or more paid zero in taxes.

[5] Email from Christopher Allanach, Oregon Legislative Revenue Office, to Chuck Sheketoff, Oregon Center for Public Policy, July 24, 2014.

– See more at: http://www.ocpp.org/2015/03/30/fs20150330-corporations-escape-minimum-tax/#sthash.xlRksZz4.dpuf